By Dave Ransom of McDermott, Will & Emery

Late in December, right before the holidays, the U.S. Congress did what it often does: At the literal 11th hour, Congress passed legislation that will fund the operations of the federal government through September 30, 2020.

Had Congress failed to pass these appropriations bills (or had President Trump refused or declined to sign them into law), the federal government (or big parts of it) would have shut down due to a lack of funding.

Neither Democrats nor Republicans wanted that this year. Instead, the leaders in each party, and the President, cooperated and negotiated on these bills. And now, the federal government will continue to operate.

Everyone in Washington, D.C., knows that these so-called “omnibus” appropriations bills (where several funding bills are packaged into one or two bills) are really nothing less than an opportunity to tuck extraneous measures that are unrelated to the underlying appropriations bills into those bills.

Predictably, that’s exactly what happened this year. That is, deep in the nearly 2,000-page “Further Consolidated Appropriations Act,” (H.R. 1865) – a bill that funds, among others, the departments of Labor, Health and Human Services, and Agriculture – is “Division Q – Revenue Provisions.”

Division Q is where the Kombucha Brewers International (KBI) and our allies on Capitol Hill had hoped to place the “KOMBUCHA Act” (S. 926/H.R. 1961) to ensure its enactment into law.

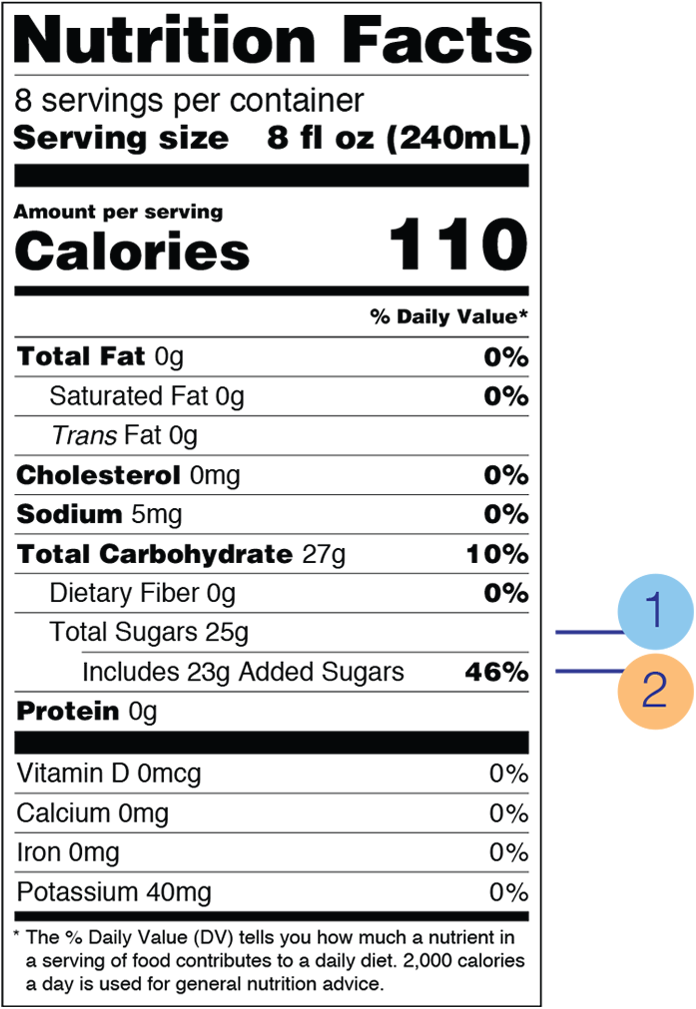

Recall that our bipartisan bill, the KOMBUCHA Act, is non-controversial and would do one thing: It would raise the alcohol by volume (ABV) threshold for Kombucha to 1.25% ABV from the current threshold of 0.5% ABV. Today, as you know, if your Kombucha leaves the brewery at, say, 0.4% ABV but increases to above 0.5% ABV after leaving the brewery, you are subject to federal excise taxes intended for beer.

That is a patently unfair and outdated result. The Congress never intended to make Kombucha subject to federal excise taxes intended for beer. So today, KBI and our friends in Congress are trying to change the law by increasing the threshold for Kombucha to 1.25% ABV. Only Kombucha above that level (1.25%) would be subject to federal excise taxes if the KOMBUCHA Act became law.

Unfortunately, however, Congressional leaders chose to strictly limit the tax provisions included in “Division Q” to already expired or expiring tax provisions. For example, the “mine rescue team training [tax] credit” expired on December 31, 2017, nearly two full years ago. In Division Q, it was extended by simply striking the date December 31, 2017, and inserting “December 31, 2020.”

Similarly, American small craft beer brewers have enjoyed a lower federal tax rate on the beer they produce since January 1, 2018. However, that lower rate was set to expire on December 31, 2019. In Division Q of the Further Consolidated Appropriations Act, the 2019 date was struck and in its place was inserted, “December 31, 2020.”

Small, craft beer brewers – who have been arguing to make the lower tax rate permanent – will enjoy the lower rate for at least one more year. Something (a one-year extension of lower rates) is better than nothing.

And so it went in “Division Q – Revenue Provisions.” KBI and our allies had hoped that Congressional leaders would be open to including additional, non-controversial provisions in that section of the bill. They did that in 2015 when Congress passed the “Protecting Americans from Tax Hikes (PATH) Act.” For example, in the PATH Act, Congress tweaked several provisions related to hard cider.

This year, though, Congress took a much more limited approach.

Despite all this, KBI, the Kombucha industry, and our allies have real opportunities in 2020 to try to enact the KOMBUCHA Act.

Many tax provisions were left on the cutting room floor in December 2019. Chief among those is a tax change that would benefit retailers who make improvements to their property. The retailers will likely pull out the stops to try to secure passage of their provision. Likewise, there are an array of so-called “technical corrections” that were mostly just drafting errors in the Tax Cuts and Jobs Act of 2017. Republicans, in particular, want to clean up those technical corrections.

Any effort to address a tax provision in Congress in 2020 is an opportunity for KBI to try to include the KOMBUCHA Act and secure passage of it.

In the meantime, we will be covering Capitol Hill to educate lawmakers and staff about the need for the KOMBUCHA Act and to seek their support for including it in any tax legislation considered by Congress.

We hope you will consider joining this effort in 2020 to spread the word about the growing and vibrant Kombucha industry, and the need to enact the KOMBUCHA Act.

NEXT HILL CLIMB – MAY 13th, 2020 – Washington, DC

Stay tuned for more details on how you can engage the civic process to benefit your business and industry. If you are interested in participating, please send an email to admin@kombuchabrewers.org – ALL KOMBUCHA BREWERS ARE INVITED TO ATTEND!

Marian Flaxman, current LGO coordinator, will be reaching out to brands in various states as part of our continued effort to educate and inform our Congresspeople & Senators about how the KOMBUCHA Act will benefit their constituents and our growing industry.

Dave Ransom will be joining us at KombuchaKon ’20 to present the latest update at the Brewery Members Meeting. Register today!

David Ransom

McDermott Will & Emery LLP