Kombucha es un producto que se puede producir de manera segura tanto en casa como de manera comercial. Al ser un alimento tradicional fermentado, sus componentes microbianos y los ácidos orgánicos que produce aseguran que se mantenga bien preservada, incluso sin refrigeración. El papel de los alimentos fermentados precede otros tipos de tecnologías de preservación tales como refrigeración, pasteurización o conservantes químicos.

Colombia tiene una larga historia de utilizar alimentos fermentados para proveer alimentos altos en nutrientes a su población nativa. La cassava, el cacao y el maíz han sido fermentados por medio de procesos tradicionales para crear almidón agrio, chicha, champús, masa agria, guarapo, y muchas cosas más .

La kombucha es originaria de Asia y ha viajado por el mundo muchas veces donde ha disfrutado de popularidad como una bebida casera en China, Japón, Corea, Rusia, Alemania, Italia y Estados Unidos. Fue en los Estados Unidos donde la bebida salió a la venta por primera vez en 1995.

KBI responde a cada una de las preocupaciones del gobierno colombiano para demostrar que la industria comercial de kombucha tiene políticas responsables y proactivas establecidas para asegurar la seguridad de nuestros productos para todos. Sabemos que esta vibrante industria puede ofrecer una alternativa saludable tanto a los refrescos y jugos como a las bebidas energéticas llenas de químicos. Empoderar y educar a los productores de kombucha crea un ambiente donde los consumidores tienen más opciones, ofrece oportunidades económicas para más personas y genera una población más saludable, lo cual la responsabilidad del gobierno.

Kombucha Brewers International Response to INVIMA of Colombia

Kombucha is an incredibly safe product to brew at home as well as commercially. As a traditional fermented food, it’s microbial makeup and the organic acids it produces ensures that it is well preserved even without refrigeration. The role of fermented foods far precedes other types of preservation technology such as refrigeration, pasteurization or chemical preservatives.

Colombia has a long history of using fermented foods to provide nutrient dense foods for their native population. Cassava, cacao and maize have all been fermented through traditional processes to create almidón agrio, chicha, champús, masa agria, guarapo and many more. Kombucha originates in Asia and has traveled the world many times over where it has enjoyed popularity primarily as a home brewed beverage from China, Japan and Korea to Russia, Germany, Italy and the United States. It is in the US where the beverage first became available for purchase in 1995.

KBI addresses each of the concerns laid out by the Colombian government to demonstrate that the commercial kombucha industry has responsible and proactive policies in place to ensure the safety of our products for all people. We know that this vibrant industry can provide a healthier alternative to sugary sodas and juices as well as chemical laden energy drinks. Empowering and educating kombucha producers creates an environment where consumers have more choice, provides economic opportunities to more people and generates a healthier populace which reduces the burden on governments.

¿Cómo garantizar el contenido microbiológico para garantizar la ausencia de patógenos?

Con respecto a la seguridad de producción y el consumo humano, sus miles de años de historia son un testamento, ya que los humanos no consumirían recursos, tiempo o energía produciendo un alimento que los dañara. Varios estudios han demostrado que el nivel de pH y el perfil de ácido orgánico de la kombucha previene la contaminación a manos de patógenos comunes, incluyendo E. coli, salmonela, listeria, entre otros.

Los invitamos a leer nuestra hoja informativa de la industria para encontrar información adicional.

How does one ensure microbiological content to guarantee the non-presence of pathogens?

Regarding safety for production and human consumption, its thousands-year-old history is a testament, as humans would not spend resources, time or energy on producing a food that could harm them. Many research papers have demonstrated that kombucha’s unique pH level and organic acid profile prevents contamination by a host of common pathogens including E. coli, Salmonella, Listeria and many others.

We invite you to read our industry fact sheet for additional information.

¿Cuáles son las mejores prácticas, procesos y regulaciones que la industria utiliza para garantizar la cualidad del SCOBY?

Pueden leer las Mejores Prácticas de KBI aquí → https://kombuchabrewers.org/wp-content/uploads/2019/06/Best-Practices-Espa%C3%B1ol.pdf

KBI ha trabajado con muchos gobiernos para garantizar que prácticas seguras sean utilizadas y ayudó de manera directa a los productores brasileños para establecer su Estándar de Identidad, el cual menciona algunas de las especificaciones técnicas fundamentales para la kombucha. KBI hará público su Código de Prácticas y programa de privacidad en verano del 2020.

What are the best Practices, process and controls that the industry uses to guarantee the SCOBY quality?

You may read the KBI Best Practices in Spanish here →

https://kombuchabrewers.org/wp-content/uploads/2019/06/Best-Practices-Espa%C3%B1ol.pdf

KBI has worked with many governments to ensure safe practices are utilized and directly assisted our Brazilian producers to establish their Standard of Identity, which lists some of the critical technical specifications for kombucha. KBI will be releasing our Code of Practice and seal program in the summer of 2020.

¿Qué características físicas o químicas son analizadas para aprobar la calidad del SCOBY?

Los miembros de KBI reciben entrenamiento para desarrollar planes HACCP para garantizar la seguridad de las prácticas de producción y demostrar un amplio conocimiento de sus procesos. Nuestros puntos críticos de control consisten en niveles de pH controlados en todo momento junto con inspecciones visuales para eliminar los cultivos que presenten moho. Al ser un organismo abundante, cualquier manifestación es visible para el ojo de inmediato ya que el moho que se produce en la kombucha es el mismo que se produce en cualquier otro alimento.

What physical or chemical characteristics are analyzed to approve the quality of the SCOBY?

KBI members receive training in how to develop HACCP plans to ensure safe brewing practices and to demonstrate full knowledge of their processes. Our critical control points consist of proper pH levels maintained at all times along with visual inspections to eliminate cultures that exhibit mold. As a hearty organism, any infestation is immediately apparent to the naked eye, as the mold that occurs on kombucha is the same as mold on any other food product.

Si el SCOBY se echa a perder, ¿qué se puede hacer para reestablecer su calidad?

Los SCOBY normalmente son organismos resistentes, y mientras tengan los nutrientes y los controles ambientales apropiados, son fáciles de cuidar. Los cultivos de moho y todo el líquido deben desecharse de inmediato. Los SCOBY pueden conseguirse por medio de proveedores comerciales o pueden crearse nuevos cultivos al trabajar con los saludables que ya se tienen.

If the SCOBY goes bad, what can be done to reestablish SCOBY quality?

SCOBYs are generally hardy organisms, and as long as they have proper nutrients and environmental controls, they are easy to care for. Moldy cultures, along with all of the liquid, are to be disposed of immediately. SCOBYs are available for purchase from commercial suppliers, or new cultures may be cultivated by working with existing cultures that are healthy.

¿Hay documentos con las prácticas principales de la industria para detener la fermentación del alcohol?

Como se menciona en Mejores Prácticas, la kombucha cruda almacenada a la temperatura apropiada mantiene el control de calidad por más tiempo. La kombucha tradicional es fermentada, baja en alcohol sin efectos embriagantes que normalmente se consume cruda, es decir no pasteurizada, para proteger los probióticos y los nutrientes vivos y evitar que se dañen.

Que no esté pasteurizada significa que no ha sido tratada con calor ni químicos. Al seguir siendo un producto en crudo, puede experimentar leves cambios en etanol mientras el proceso de fermentación continúa dentro de la botella.

Para detener el proceso, la kombucha cruda debe mantenerse fría en todo momento para mantener la integridad del producto y prevenir la fermentación dentro de la botella.

La temperatura del almacenamiento debe mantenerse a una temperatura de 34-40º F /1.1-4.4ºC para alentar la fermentación de la kombucha a lo largo de la cadena de suministro.

La vida útil de la kombucha se define por la cantidad de tiempo que puede permanecer almacenada en frío antes de que los niveles de etanol sobrepasen el límite legal (que varía dependiendo de la ubicación).

Los productos que dicen ser crudos y poder almacenarse no se reconocen como estables sin evidencia complementaria empírica por parte de un laboratorio de pruebas de terceros para verificar que el nivel de etanol se mantenga dentro del límite legal de su ubicación. Productos de este tipo no existen en el mercado estadounidense ya que la kombucha cruda está sujeta a su refrigeración.

Are there documents with the industry leading practices to stop the alcoholic fermentation.

As outlined in the Best Practices, raw kombucha stored at the appropriate temperatures maintains quality control for extended periods of time. Kombucha is a traditionally fermented, low alcohol, non-intoxicating beverage that is most commonly consumed raw, meaning unpasteurized, to protect the probiotics and nutrients in a living form from being damaged.

Unpasteurized means not subject to pasteurization via heat or chemical means. As a result of remaining a raw product, it can experience slight shifts in ethanol as the fermentation process continues in the bottle.

To arrest that process, raw Kombucha must be kept cold at all times to maintain the integrity of the product and to prevent over fermentation in the bottle.

Cold storage ought to be maintained at 34-40º F /1.1-4.4ºC to slow the fermentation of the Kombucha throughout the supply chain.

Shelf life of Kombucha is determined by how long the product can remain in cold storage before the ethanol level goes above the prescribed legal limit (will vary based on location).

Products that claim to be both shelf-stable and raw are not currently recognized as stable without further evidence vis-a-vis shelf life testing by a third party lab to verify that the ethanol level remains within the legal limit for that location. No such products currently exist in the US marketplace as all raw Kombucha is subject to refrigeration.

¿Hay documentos donde podemos probar que la FDA ha confirmado que la kombucha es legal; que está catalogada como una comida y es segura para consumo humano?

Todos los miembros de KBI en Estados Unidos deben matricular sus instalaciones de acuerdo con la Ley contra el Bioterrorismo del 2002. Hay más de 750 marcas comerciales de kombucha en Estados Unidos nada más. Así que aunque la FDA no tiene una postura oficial en cuanto a la kombucha, claramente está enterada de la industria y lo considera un producto seguro.

Is there documentation to prove the FDA has stated that Kombucha is legal; that is catalogued as a food and save to consume by humans?

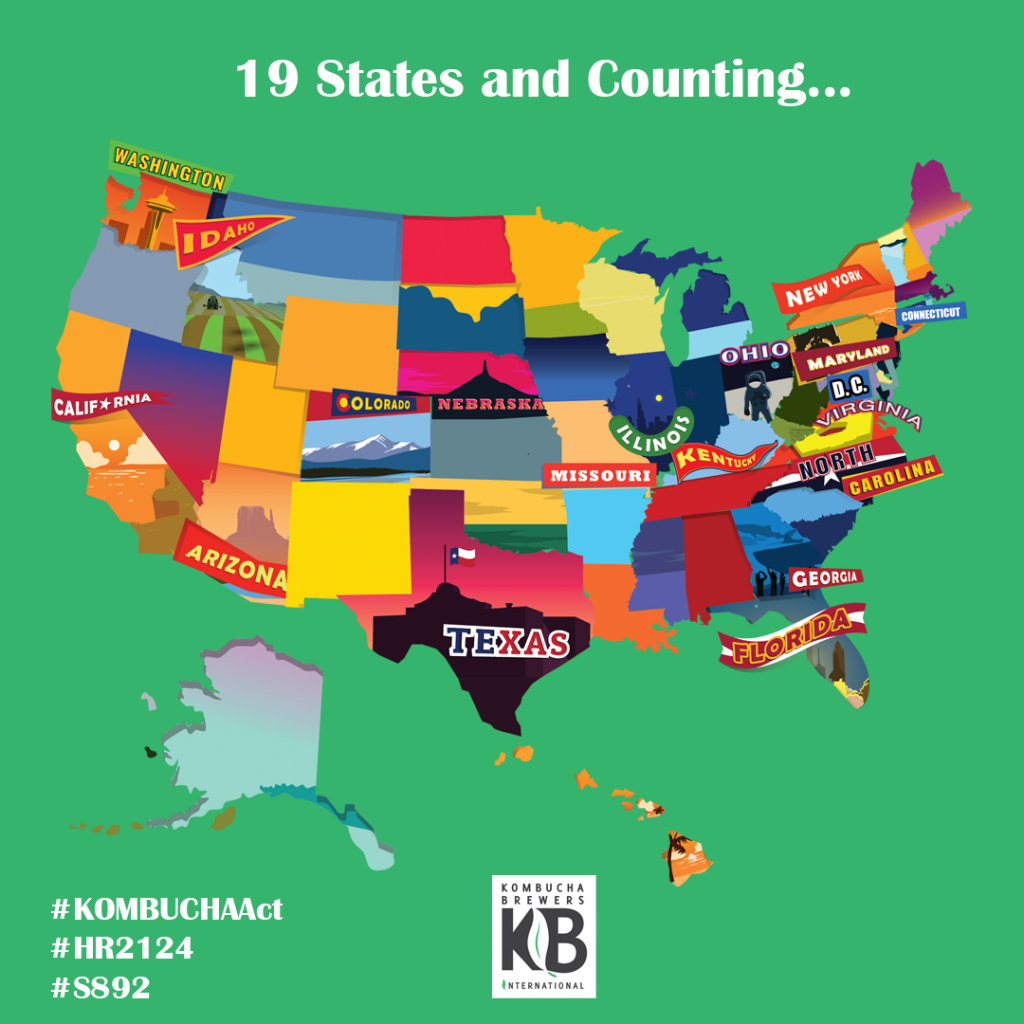

All KBI members based in the U.S. are required to enroll their facility in accordance with the Bioterrorism Act of 2002. There are more than 750 commercial kombucha brands in the United States alone. So while the FDA doesn’t have an official stance on kombucha, it is clearly aware of the industry and considers our products safe.

¿Tienen algún documento que pueda ayudarnos en nuestra misión de hacer legal la kombucha en Colombia?

Múltiples estudios discuten los beneficios para los humanos. Aquí hay una reseña de varios estudios sobre este tema:

https://www.researchgate.net/profile/Joselina_Huerta/publication/323136183_A_review_on_health_benefits_of_kombucha_nutritional_compounds_and_metabolites/links/5cf99170299bf13a384327a5/A-review-on-health-benefits-of-kombucha-nutritional-compounds-and-metabolites.pdf

Are there any toxicological studies that proves that kombucha is safe for human consumption?

Numerous studies discuss its benefits for humans. Here is a review of several studies on this subject:

https://www.researchgate.net/profile/Joselina_Huerta/publication/323136183_A_review_on_health_benefits_of_kombucha_nutritional_compounds_and_metabolites/links/5cf99170299bf13a384327a5/A-review-on-health-benefits-of-kombucha-nutritional-compounds-and-metabolites.pdf

¿Hay estudios que prueben que mantener el nivel de pH de la kombucha debajo de 3.5 es un método aprovado para evitar los patógenos en la kombucha?

Un conocimiento básico de química puede probar que esto es verdad. Aquí hay algunos estudios adicionales que se pueden revisar:

https://research.kombuchabrewers.org/?query=antibacterial

Are there any studies that proves that maintaining the kombucha ph below 3.5 is an approved method to keep pathogens out of the kombucha?

Simple knowledge of chemistry will prove that to be true. Here are some additional studies for review:

https://research.kombuchabrewers.org/?query=antibacterial

¿Hay documentos que prueben que la kombucha no genera metanol durante el proceso de fermentación?

Ninguno de los estudios sobre la kombucha han mostrado la presencia de metanol. La producción de metanol se relaciona con la cantidad de pectinas en la hierba. El té y el azúcar no contienen pectinas y, por lo tanto, no pueden producir metanol.

Any documents that proves that kombucha does not generate methanol in the fermentation process?

None of the studies on kombucha have shown the presence of methanol. Methanol production is linked to pectin content in the wort. Tea and sugar do not contain pectin and therefore cannot produce methanol.

¿Tienen algún documento que pueda ayudarnos en nuestra misión de hacer legal la kombucha en Colombia?

Any other document that you have that can help us in our quest to make legal kombucha in Colombia?

https://www.fda.gov/regulatory-information/search-fda-guidance-documents/cpg-sec-110300-registration-food-facilities-under-public-health-security-and-bioterrorism

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5028366/

Entra a la base de datos de investigaciones sobre kombucha → https://research.kombuchabrewers.org/

Access the Kombucha Research Database here to find numerous studies → https://research.kombuchabrewers.org/

ALERTA SANITARIA Dirección de Alimentos y Bebidas Alerta No. 024-2020

Alimentos que se comercializan con la expresión “Kombucha”

Nombre del producto: Alimentos que se comercializan con la expresión “Kombucha”

Registro sanitario: RSAV15I10313/RSA-004946-2017 / RSA-006687-2018 /RSA-005012-2017 / RSA-0007265-2018 / NSA-005392-2018

Fuente de la alerta: Denuncias y acciones de inspección, vigilancia y control (IVC) No. Identificación interno: AA200101

Descripción del caso El Instituto Nacional de Vigilancia de Medicamentos y Alimentos (Invima) informa a la comunidad, que conforme a las competencias de inspección, vigilancia y control se han detectado irregularidades en relación con la siguiente declaración en alimentos: Kombucha es una bebida elaborada a partir de té endulzado y fermentado utilizando un cultivo simbiótico de bacterias y levaduras (SCOBY). En el mercado se han encontrado algunas bebidas que utilizan como ingrediente el “SCOBY”. Al cual se le atribuyen diferentes propiedades en salud, según referencias bibliográficas . Cabe anotar que el “SCOBY” es un ingrediente que no ha sido autorizado por el Invima para su uso en alimentos y bebidas. Bogotá, 19 Febrero 2020 Marcas “o.k. kombucha”, “Alino”, “HAPPY”, “La fantástica”, “Kogui kombucha”, “Coordenada 0” y “Yogi”

Por lo anterior el Invima se permite informar a la población en general que los alimentos que se comercializan en Colombia y que contienen la expresión kombucha, presentan la siguiente situación sanitaria:

1. En relación con la autorización para comercializar alimentos a los cuales el Invima les otorgó Registro Sanitario o Notificación Sanitaria, y que están utilizando dentro de su composición el ingrediente “SCOBY” o están haciendo uso de la expresión “Kombucha”, el Invima hace claridad de lo siguiente:

a) Para el Registro Sanitario RSAV15I10313 correspondiente al alimento “bebida con té diferentes variedades”, que incluye las marcas “o.k. kombucha”, “alino”, en presentación comercial caja por 6, 12 y 24 unidades de 250, 330, 500 y 1000 mililitros, y cuyo fabricante es Cohen Leiderman Flora propietaria del establecimiento de comercio o.k. kombucha, mediante acciones de Inspección, Vigilancia y Control se evidenció que el fabricante utiliza “cultivo probiótico de Kombucha”, el cual no está aprobado en el Registro Sanitario, así como el incumplimiento del rotulado y publicidad de la bebida con té variedades, marca kombucha.

b) Para el Registro Sanitario RSA-004946-2017 correspondiente al alimento “bebida con té diferentes variedades”, que incluye la marca “HAPPY” en presentación comercial botellas (PET o vidrio) de 120, 180, 200, 250, 320, 350, 500, 750, 1000 y 3780 mililitros, y cuyo fabricante es Drink With Purpose S.A.S, se evidenció que en el proceso de fabricación del alimento se estaba llevando a cabo fermentación alcohólica obtenida mediante la adición del “SCOBY” como ingrediente y, adicionalmente, el rotulado del alimento hace alusión a la expresión “kombucha”.

c) Para el Registro Sanitario RSA-006687-2018 correspondiente al alimento “bebida con té”, que incluye la marca “La fantástica” en presentación comercial botellas de 200, 400, 600, 800 y 1000 mililitros, y cuyo fabricante es ST Agnes Brewing Company té vivo la fantástica, se evidenció que la actual dirección del fabricante no corresponde con la suministrada ante el Invima al momento de solicitar el Registro Sanitario.

d) Para el Registro Sanitario RSA-005012-2017 correspondiente al alimento “Bebida con té verde y negro diferentes variedades”, que incluye la marca “Kogui kombucha” en presentación comercial de 250 a 1000 mililitros, y cuyo fabricante es el establecimiento de comercio Koghi Products, se evidenció que en el proceso de fabricación del alimento se estaba llevando a cabo fermentación alcohólica, no autorizada.

e) El Registro Sanitario RSA-0007265-2018 correspondiente al alimento “bebida a base de agua y té”, que incluye la marca “Coordenada 0” en presentación comercial de frasco de vidrio de 10 hasta 10000 mililitros, y cuyo fabricante es Coordenada 0 SAS, se encuentra suspendido.

f) Para la Notificación Sanitaria NSA-005392-2018 correspondiente al alimento “Infusiones de té diferentes variedades”, que incluye la marca “Yogi” en presentación comercial bolsas de té y cuyo fabricante es “East West Tea Company” (Estados Unidos) e importado a Colombia por Green Tradings S.A.S., se evidenció que la dirección suministrada ante el Invima por el importador corresponde a un domicilio del cual se desconoce el tipo de actividad comercial allí realizada.

2. Respecto a la vigilancia de la publicidad en diferentes medios, el Invima identificó que en algunas páginas de internet se promocionan alimentos que utilizan la expresión Kombucha, declarando propiedades en salud; preventivas, curativas y/o terapéuticas, lo que conlleva al incumplimiento de la legislación sanitaria vigente (artículos 272 y 274 de la ley 9 de 1979 y la resolución 5109 de 2005 – artículos 4 y 5). Se enlistan algunas de las páginas de internet en donde se ha identificado este tipo de publicidad:

a. https://fitfoodmarket.co/tienda/bebidas-y-tes/happy-kombucha/

b. https://moncielvidasana.com/kombucha-kefir-y-fermentos/132-104-kombucha-la-fantastica210mL.htmL

c. https://articulo.mercadolibre.com.co/MCO-483957130-yogi-tea-kombucha-te-verde-16-ea- _JM?quantity=1#position=10&type=item&tracking_id=fd88e642-a51c-463d-bc5e-dad3c8e721dc

d. https://www.instagram.com/kombuchalafantastica/?hl=es-la

e. https://www.instagram.com/koguikombucha/?hl=es-la

f. https://happykombuchalab.com/

g. https://www.instagram.com/ok_kombucha/

h. https://www.facebook.com/OKKombucha.ca/

i. https://kombuchalafantastica.com/

j. https://www.alivekombucha.co/

k. https://www.instagram.com/bvida.kombucha/?hl=es-la

l. https://www.instagram.com/tevivokombucha/?hl=es-la

m. https://www.instagram.com/guarapakombucha/?hl=es-la

n. https://www.instagram.com/aborigenkombucha/?hl=es-la

o. https://es-la.facebook.com/kombucha0/

De acuerdo con lo descrito anteriormente, el Invima advierte que los productos relacionados no cumplen con la normatividad sanitaria y por lo tanto no están autorizados para su comercialización, razón por la cual, se están adelantando las actuaciones administrativas para verificar las condiciones de los registros sanitarios y las declaraciones de los ingredientes de cada uno de los productos. Medidas para la comunidad en general Considerando lo anterior, tenga en cuenta los siguientes aspectos: 1. Absténgase de adquirir y consumir los alimentos que listen o hagan alusión a las expresiones “Kombucha” o “SCOBY”, u otros que existan en el mercado, tengan o no Registro Sanitario, y que utilicen en su rótulo palabras asociadas a las expresiones anteriormente descritas. 2. Informe de manera inmediata al Invima, o a las Entidades Territoriales de Salud, si tiene conocimiento de lugares donde se elaboren, distribuyan o comercialicen alimentos que listen dentro de sus ingredientes “SCOBY” o que declaren en su denominación la expresión “Kombucha”.

Medidas para secretarías de salud departamentales, distritales y municipales Categoría Especial, I, II y III:

1. Realizar las actividades de inspección, vigilancia y control (IVC) en los establecimientos donde potencialmente puedan comercializarse los alimentos citados, verificando la existencia de productos que declaren las expresiones “SCOBY” y/o “Kombucha” en su rotulado o etiquetado.

2. Durante las actividades de Inspección, Vigilancia y Control (IVC) verificar si existe publicidad de alimentos que incluyan las expresiones “SCOBY” y/o “Kombucha” y su relación con propiedades en salud; preventivas, curativas y/o terapéuticas.

3. Comunicar al Invima los resultados de las acciones de Inspección, Vigilancia y Control (IVC) a los correos alertasalimentos@invima.gov.co y contactoets@invima.gov.co, en caso de evidenciar uno o más de los incumplimientos referidos. Si desea obtener mayor información comuníquese con el Invima a: alertasalimentos@invima.gov.co o al teléfono 294 8700, extensiones 3844 y 3846 – Dirección de Alimentos y Bebidas. Igualmente se podrán realizar peticiones, quejas, reclamos, denuncias o sugerencias: https://www.invima.gov.co/peticiones-quejas-reclamos-y-sugerencias Consultar registros sanitarios: http://consultaregistro.invima.gov.co:8082/Consultas/consultas/consreg_encabcum.jsp En los siguientes enlaces podrá acceder directamente a la información de su interés en la página web del Invima. Realizar peticiones, quejas, reclamos, denuncias o sugerencias Consultar registros sanitarios Realizar reportes en línea de eventos adversos Farmacovigilancia Reactivovigilancia Tecnovigilancia

HEALTH ALERT Food and Beverage Department Alert No. 024-2020

Foods that are marketed with the expression “Kombucha”

Product name: Foods that are marketed with the expression “Kombucha”

Sanitary record: RSAV15I10313 / RSA-004946-2017 / RSA- 006687-2018 / RSA-005012-2017 / RSA-0007265-2018 / NSA-005392-2018

Source of alert: Complaints and actions of inspection, surveillance and control (IVC) No. Internal identification: AA200101

Description of the case The National Institute of Food and Drug Surveillance (Invima) informs the community that, according to the inspection, surveillance and control powers, irregularities have been detected in relation to the following food declaration: Kombucha is a beverage made from sweetened and fermented tea using a symbiotic culture of bacteria and yeasts (SCOBY). In the market some drinks have been found that use the “SCOBY” as an ingredient. To which different health properties are attributed, according to bibliographic references. It should be noted that the “SCOBY” is an ingredient that has not been authorized by the Invima for use in food and beverages. Bogotá, February 19, 2020 Marks “ok kombucha”, “Alino”, “HAPPY”, “La fantastic”, “Kogui kombucha”, “Coordinate 0” and “Yogi”

By the above the Invima is allowed to inform the general population that the foods that are sold in Colombia and that contain the expression kombucha, present the following sanitary situation:

1. In relation to the authorization to commercialize foods to which the Invima granted them Sanitary Registry or Sanitary Notification, and that they are using the ingredient “SCOBY” within their composition or are making use of the expression “Kombucha”, the Invima makes clear of the following:

a) For the Sanitary Registry RSAV15I10313 corresponding to the food “drink with different varieties of tea ”, which includes the brands“ ok kombucha ”,“ alino ”, in commercial presentation box for 6, 12 and 24 units of 250, 330, 500 and 1000 milliliters, and whose factory before Cohen Leiderman Flora owns the ok kombucha trade establishment, through Inspection, Surveillance and Control actions it was evidenced that the manufacturer uses “Kombucha probiotic culture”, which is not approved in the Sanitary Registry, as well as the breach of the labeling and advertising of the beverage with tea varieties, Kombucha brand.

b) For the Sanitary Registry RSA-004946-2017 corresponding to the food “drink with tea different varieties”, which includes the brand “HAPPY” in commercial presentation bottles (PET or glass) of 120, 180, 200, 250, 320, 350 , 500, 750, 1000 and 3780 milliliters, and whose manufacturer is Drink With Purpose SAS, it was evidenced that alcoholic fermentation was obtained in the food manufacturing process obtained by adding “SCOBY” as an ingredient and, additionally, the labeling of the food refers to the expression “kombucha”.

c) For the Sanitary Registry RSA-006687-2018 corresponding to the food “drink with tea”, which includes the brand “The fantastic” in commercial presentation bottles of 200, 400, 600, 800 and 1000 milliliters, and whose manufacturer is ST Agnes Brewing Company live the fantastic, it was evident that the current address of the manufacturer does not correspond to that supplied before the Invima at the time of requesting the Sanitary Registry.

d) For the Sanitary Registry RSA-005012-2017 corresponding to the food “Drink with green and black tea different varieties”, which includes the brand “Kogui kombucha” in commercial presentation of 250 to 1000 milliliters, and whose manufacturer is the establishment of commerce Koghi Products, it was evidenced that in the process of manufacturing the food alcoholic fermentation was taking place, not authorized.

e) The Sanitary Registry RSA-0007265-2018 corresponding to the food “drink based on water and tea”, which includes the brand “Coordinate 0” in commercial presentation of glass jar of 10 up to 10,000 milliliters, and whose manufacturer is Coordinate 0 SAS, is suspended.

f) For the Sanitary Notification NSA-005392-2018 corresponding to the food “Tea infusions different varieties”, which includes the brand “Yogi” in commercial presentation of tea bags and whose manufacturer is “East West Tea Company” (United States) and Imported to Colombia by Green Tradings SAS, it was evidenced that the address supplied to the Invima by the importer corresponds to a domicile whose type of commercial activity is unknown.

2. Regarding the surveillance of advertising in different media, Invima identified that in some websites, foods that use the expression Kombucha are promoted, declaring health properties; preventive, curative and / or therapeutic, which leads to non-compliance with current health legislation (articles 272 and 274 of law 9 of 1979 and resolution 5109 of 2005 – articles 4 and 5). Some of the websites where this type of advertising has been identified are listed:

a. https://fitfoodmarket.co/tienda/bebidas-y-tes/happy-kombucha/

b. https://moncielvidasana.com/kombucha-kefir-y-fermentos/132-104-kombucha-la-fantastica210mL.htmL

c. https://articulo.mercadolibre.com.co/MCO-483957130-yogi-tea-kombucha-te-verde-16-ea- _JM? quantity = 1 # position = 10 & type = item & tracking_id = fd88e642-a51c-463d-bc5e- dad3c8e721dc

d. https://www.instagram.com/kombuchalafantastica/?hl=en-la

e. https://www.instagram.com/koguikombucha/?hl=en-la

f. https://happykombuchalab.com/

g. https://www.instagram.com/ok_kombucha/

h. https://www.facebook.com/OKKombucha.ca/

i. https://kombuchalafantastica.com/

j. https://www.alivekombucha.co/

k. https://www.instagram.com/bvida.kombucha/?hl=en-la

l. https://www.instagram.com/tevivokombucha/?hl=en-la

m. https://www.instagram.com/guarapakombucha/?hl=en-la

n. https://www.instagram.com/aborigenkombucha/?hl=en-la

or. https://es-la.facebook.com/kombucha0/

As described above, Invima warns that the related products do not comply with sanitary regulations and therefore are not authorized for marketing, which is why, administrative actions are being carried out to verify the conditions of the sanitary records and the declarations of the ingredients of each of the products.

Measures for the community in general considering the above, consider the following aspects:

1. Refrain from acquiring and consuming the foods you listen to or make reference to the expressions “Kombucha” or “SCOBY”, or others that exist in the market, whether or not they have a Sanitary Registry, and that use words associated with the expressions described above on their label.

2. Immediately inform Invima, or the Territorial Health Entities, if you are aware of places where food is prepared, distributed or marketed within the “SCOBY” ingredients or that declares the expression “Kombucha” in its name.

Measures for departmental, district and municipal health secretariats Special Category, I, II and III:

1. Carry out inspection, surveillance and control (IVC) activities in establishments where the aforementioned foods can potentially be marketed, verifying the existence of products that declare the expressions “SCOBY” and / or “Kombucha” in their labeling or labeling.

2. During the Inspection, Surveillance and Control (IVC) activities, verify whether there is food advertising that includes the expressions “SCOBY” and / or “Kombucha” and its relation to health properties; preventive, curative and / or therapeutic.

3. Communicate to Invima the results of the Inspection, Surveillance and Control (IVC) actions to the emails alertsalimentos@invima.gov.co and contactoets@invima.gov.co, in case of evidencing one or more of the aforementioned breaches. If you would like more information, please contact the Invima at: alertsalimentos@invima.gov.co or by phone 294 8700, extensions 3844 and 3846 – Food and Beverage Department. Likewise, requests, complaints, claims, complaints or suggestions may be made: https://www.invima.gov.co/pecionales-quejas-reclamos-y-sugerencia Consult health records: http://consultaregistro.invima.gov.co : 8082 / Queries / consultations / consreg_encabcum.jsp In the following links you can directly access the information of your interest on the Invima website. Make requests, complaints, claims, complaints or suggestions Consult health records Make online reports of adverse events Pharmacovigilance Reagent Surveillance Tecnovigilancia